INFLATION FIGHTER CORE-4 PORTFOLIO

The Inflation Fighter Core-4 Portfolio provide investors with relief during an unexpected jump in inflation. Stock and bond investors are always worried about inflation because it erodes the buying power of their gains. Higher inflation can also lead to higher interest rates. The Federal Reserve typically increases short-term rates when inflationary pressures increase, and bond market participates often react by selling long-term bonds, which pushes long-term rates higher.

Here are the four categories of investment in the Inflation Fighter Core-4 Portfolio:

- Total Global Equity Fund

- Commercial Real Estate (REITs)

- Treasury Inflation Protected Securities

- Interest Rate Hedged Securities

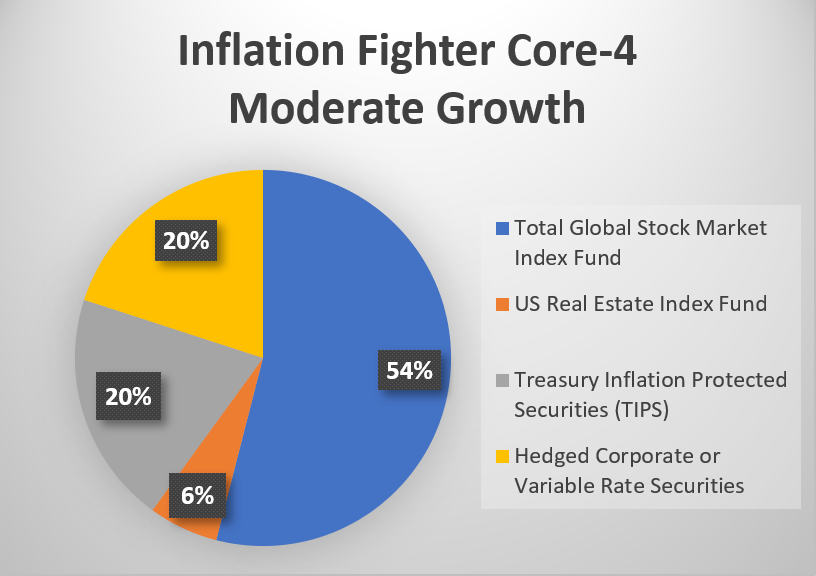

The Inflation Fighter Core-4 Portfolio hold securities that help reduce the pain from unexpected inflation in several ways. First, the equity portion is globally market weighted to about 45% in foreign stocks. This hedges a decline in US dollar, which often occurs during inflationary periods. Second, Treasury Inflation Protected Securities (TIPS) gain in line with inflation in addition to providing regular interest payments. Third, interest rate hedged securities are protected from higher rates or adjust their yields up when rates jump. Last, rental real estate is a hedge because landlords can increase rent when inflation occurs.

The Inflation Fighter Core-4 Portfolio strives to reduce the impact of unexpected inflation using various means, but these hedges are not guaranteed to maintain portfolio principle in the short-term. Every investment strategy has risk. Past performance of this portfolio during periods of unexpected inflation is not a guarantee of future results.

MODERATE GROWTH INFLATION FIGHTER CORE-4 PORTFOLIO

The Moderate Growth portfolio has an allocation of 60% in equity and 40% in fixed income.

ASSET ALLOCATION SELECTION

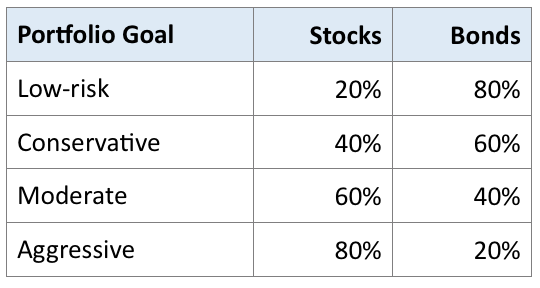

CLICK HERE to view the asset allocation of four Inflation Fighter Core-4 Portfolios ranging from Low-risk to Aggressive. More risk in a portfolio means greater short-term volatility and the expectation of higher long-term returns.

For assistance in selecting an appropriate risk level, use the Vanguard Risk Tolerance-Asset Allocation Tool or a similar questionnaire designed to recommend a stock and bond allocation.

FUND SELECTION

CLICK HERE to see suggested mutual funds and exchange-traded funds (ETFs) for each category in the Inflation Fighter Core-4. The fund selection includes the largest in each asset class and three others that are appropriate. The list does not represent the complete universe of suitable funds.

ANALYZE YOUR SECTIONS IN PORTFOLIO VISUALIZER

Here is a PORTFOLIO VISUALIZER analysis for the Inflation Fighter Core-4 Moderate Growth portfolio using funds from the Inflation Fighter Core-4 FUND SELECTION page.

You can change funds by typing in different tickers or fund names from the FUND SELECTION page or your own selections. You can also change the portfolio allocation to each fund by typing in the percentages in each asset class based on the Inflation Fighter Core-4 PORTFOLIO ALLOCATION page or using your own revised allocations. Simply enter the funds you choose and an asset allocation to each to make your analysis. Compare up to three portfolios at once.

The Portfolio Visualizer online portfolio backtesting tool allows you to construct one or more portfolios based on the selected mutual funds, ETFs and stocks to analyze and backtest portfolio returns, risk characteristics, standard deviation, annual returns and rolling returns. The results include a visualization of the portfolio growth chart and rolling returns, CAGR, standard deviation, Sharpe ratio, Sortino ratio, annual returns and inflation adjusted returns. A periodic contribution or withdrawal can also be specified together with the preferred portfolio rebalancing strategy.

GETTING HELP*

Core-4 Adviser Alliance members assist individuals and small institutional investors with all aspects of investment planning, portfolio design and account management. They also provide valuable content to the Core-4 Blog. All advisers must meet strict fiduciary standards. All advisers charge a fee for their services, which vary by firm.

*Core-4 Investing charges a fee to companies that advertise on this website. The blogs and other content provided by advertisers may facilitate their commercial purpose. Neither Core-4 Investing nor its owner guarantees the advice of any service provider; however, we do want to hear about positive and negative experiences.