SOCIALLY CONSCIOUS ESG CORE-4 PORTFOLIO

The Socially Conscious “ESG” Core-4 Portfolio provides an escape for investors whose values are at odds with companies that have conflicting environmental, social and governance (ESG) views. The issue may be tobacco companies or companies that make components for nuclear weapons or companies that don’t have a good record on human rights; whatever the issue, excluding these companies from a portfolio is the purpose of the ESG Core-4 Portfolio.

ESG is part of a broader category called SRI; sustainable, responsible and impact investing. SRI includes federal and local government projects, non-profit initiatives and private businesses. The ESG Core-4 Portfolio includes an allocation to government securities for this reason.

ESG and SRI investors hold the view that they can help the world and help themselves through their investment decisions. However, there is no guarantee doing good while doing well will lead to either. While it is a noble goal, there is an inherent cost. Higher fees and lower diversification associated with ESG funds are a hurdle to overcome, and investors should consider this before utilizing an ESG strategy.

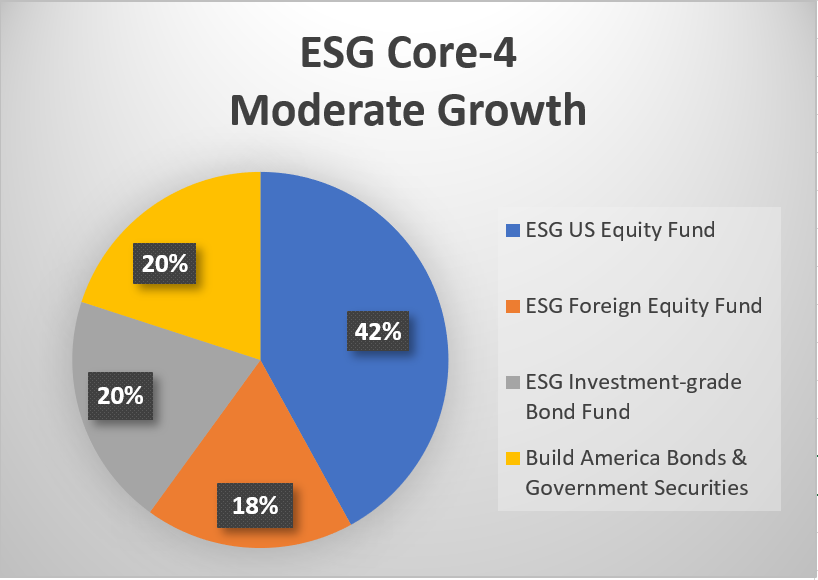

Here are the four categories of investment in the ESG Core-4 Portfolio:

- ESG US Equity Fund

- ESG Foreign Equity Fund

- ESG Investment-grade Bond Fund

- Build America Bonds & US Government Securities

ESG bond funds and ETFs are as diversified as the asset class itself. They range from ESG corporate bonds to U.S. Treasury bonds to Build America Bonds (BAB) to GNMA securities, which are government issued securities that promote affordable housing. BAB are taxable municipal bonds introduced to encourage investment in the local sector. They are debt securities issued by a state, municipality, or county to finance capital expenditures and the interest is subsidized by the federal government.

MODERATE GROWTH ESG CORE-4 PORTFOLIO

The Moderate Growth portfolio has an allocation of 60% in equity and 40% in fixed income.

ASSET ALLOCATION SELECTION

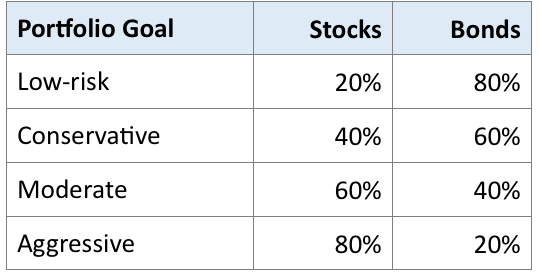

CLICK HERE to view the asset allocation of four ESG Core-4 Portfolios ranging from Low-risk to Aggressive. More risk in a portfolio means greater short-term volatility and the expectation of higher long-term returns.

For assistance in selecting an appropriate risk level, use the Vanguard Risk Tolerance-Asset Allocation Tool or a similar questionnaire designed to recommend a stock and bond allocation.

FUND SELECTION

CLICK HERE to see suggested mutual funds and exchange-traded funds (ETFs) for each category in the ESG Viewpoint Core-4. The fund selection includes the largest in each asset class and three others that are appropriate. The list does not represent the complete universe of suitable funds.

ANALYZE YOUR SECTIONS IN PORTFOLIO VISUALIZER

Here is a PORTFOLIO VISUALIZER analysis for the ESG Core-4 Moderate Growth portfolio using funds from the ESG Core-4 FUND SELECTION page.

You can change funds by typing in different tickers or fund names from the FUND SELECTION page or your own selections. You can also change the portfolio allocation to each fund by typing in the percentages in each asset class based on the ESG Core-4 PORTFOLIO ALLOCATION page or using your own revised allocations. Simply enter the funds you choose and an asset allocation to each to make your analysis. Compare up to three portfolios at once.

The Portfolio Visualizer online portfolio backtesting tool allows you to construct one or more portfolios based on the selected mutual funds, ETFs and stocks to analyze and backtest portfolio returns, risk characteristics, standard deviation, annual returns and rolling returns. The results include a visualization of the portfolio growth chart and rolling returns, CAGR, standard deviation, Sharpe ratio, Sortino ratio, annual returns and inflation adjusted returns. A periodic contribution or withdrawal can also be specified together with the preferred portfolio rebalancing strategy.

GETTING HELP*

Core-4 Adviser Alliance members assist individuals and small institutional investors with all aspects of investment planning, portfolio design and account management. They also provide valuable content to the Core-4 Blog. All advisers must meet strict fiduciary standards. All advisers charge a fee for their services, which vary by firm.

*Core-4 Investing charges a fee to companies that advertise on this website. The blogs and other content provided by advertisers may facilitate their commercial purpose. Neither Core-4 Investing nor its owner guarantees the advice of any service provider; however, we do want to hear about positive and negative experiences.